Take-home points

|

|

Bio Dr. Agrawal is a retina specialist and currently the ophthalmology lead and vice president for clinical development at Rezolute. Previously, he was senior vice president, clinical development, with Coherus Biosciences. Before Coherus, he was senior director, global research and development, at Santen. Previously, he was a clinical retina faculty member at Doheny Eye Institute, University of Southern California, and Los Angeles County Hospital. He is also the founder and chief executive officer of Retina Global, an international nonprofit that provides specialized retinal care in the United States and other countries. DISCLOSURE: Dr. Agrawal led |

Biosimilars have been shown to reduce costs across a broad range of therapeutic areas, savings that have increased as clinicians become more familiar with biosimilars and prescribe them in a growing number of patients—a dynamic that’s coming to retina now that biosimilars to the two leading anti-VEGF treatments are widely available or will be soon. Most studies also calculated that these cost savings could result in tens of thousands of additional patients being treated with biologics, which could increase substantially as the benefits of biosimilars become more widely understood.1

What are biosimilars?

A biosimilar is a biologic medication that is highly similar in its physical, chemical and biological properties to and has no clinically meaningful differences from an existing U.S. Food and Drug Administration-approved biologic, referred to as the reference product. Compared to a reference product, biosimilars are made with the same types of living sources, are given to the patients in the same way, and have the same strength, dosage, treatment benefits and potential side effects.2

Biosimilars undergo an extensive review and approval process to determine that they have no clinically meaningful differences from the reference product.3 This approval process assures that biosimilars have the same treatment benefits and risks. Considering they’re quite similar to the reference product, the Biologics Price Competition and Innovation (BPCI) Act of 2009 that defined biosimilars, proposed an abbreviated pathway for approval.4 With less time and fewer resources required for development, a biosimilar that the FDA deems safe and effective is likely to be cheaper than its reference product, thus providing patients with more treatment options, increasing access to lifesaving medications and potentially lowering health-care costs. 2

Biosimilars and interchangeability

An interchangeable biological product is a biosimilar that meets additional requirements and may be substituted for the reference product at the pharmacy, depending on state pharmacy laws.2,5

It’s important to remember that not all biosimilars are interchangeable. Companies must submit an application with adequate information to support such a determination for their product to be approved as an interchangeable biosimilar. 2,5

Recently, the FDA recommended that all labeling for biosimilars include a biosimilarity statement, which would likely avoid any confusion about interchangeable biosimilars vs. those that don’t carry that designation. Previously, the agency recommended that labeling include a statement of biosimilarity or interchangeability in the highlights section that describes the product’s relationship to its reference product. The FDA wants to make sure that a designation of interchangeability doesn’t indicate a higher level of biosimilarity in biosimilars designated as interchangeable.6

.png) |

|

To date, the only anti-VEGF biosimilars approved in the United States are Cimerli (Sandoz) and Byooviz (Biogen), both referencing Lucentis (ranibizumab, Genentech/Roche). |

Lucentis biosimilars in the United States

The FDA has approved 45 biosimilars in total,4 only two of which are approved for ophthalmic use, and both as biosimilars to ranibizumab.

The first was Byooviz (ranibizumab-nuna or SB11), which was approved in September 2021. This drug, which was developed by Samsung Bioepis and marketed in the United States by Biogen, launched with a 0.05-mg single-use vial and hence is only approved for three of the five indications for which Lucentis is approved: neovascular age-related macular degeneration; macular edema following retinal vein occlusion; and myopic choroidal neovascularization. Although it was the first ranibizumab biosimilar approved in the United States, it was the second to receive an interchangeability designation.

The FDA approved Cimerli (ranibizumab-eqrn or FYB-201) in August 2022. Developed by Bioeq AG and initially marketed in the United States by Coherus Biosciences, Sandoz has since acquired the franchise. Cimerli was approved in both 0.3- and 0.5-mg doses for all five indications for which Lucentis is approved, including diabetic macular edema and diabetic retinopathy. Cimerli is also the first to receive the interchangeability designation from the FDA.

Clinical trials for Lucentis biosimilars

Each of these Lucentis biosimilars had to go through a Phase III study to demonstrate safety and similar efficacy to Lucentis.

Byooviz underwent a randomized, double-masked, multicenter Phase III study that evaluated efficacy, safety, pharmacokinetics and immunogenicity. The study had a primary endpoint of change from baseline in best-corrected visual acuity at eight weeks and central subfield thickness at four weeks. The secondary endpoints included pharmacokinetics, safety, long-term efficacy and immunogenicity. 7,8 The study recruited 705 nAMD patients who were randomized to receive either SB11 or ranibizumab in monthly injections (0.5 mg), with 634 patients continuing to receive treatment for the entire study length of 48 weeks.

The study met the primary endpoint, as the adjusted treatment difference between SB11 and ranibizumab in BCVA was -0.8 letters (90% confidence interval [Cl] -1.8 to 0.2) and the CST change from baseline was -8 µm (95% CI -19 to 3).

The randomized clinical equivalence trial demonstrated equivalence in efficacy for both primary end points between SB11 and ranibizumab, with SB11 similar in safety and immunogenicity profiles to ranibizumab.7

The COLUMBUS-AMD trial evaluated the clinical equivalence of Cimerli to the reference product ranibizumab in patients with treatment-naive, subfoveal choroidal neovascularization caused by nAMD. The primary end point was change from baseline in BCVA, as measured by Early Treatment Diabetic Retinopathy Study letters at eight weeks before the third monthly intravitreal injection.

A two-sided equivalence test assessed the biosimilarity of FYB201 to ranibizumab, with an equivalence margin in BCVA of three ETDRS letters. This study involved 477 patients, with 238 randomized to FYB-201 and the rest to ranibizumab. Both treatment arms demonstrated an improvement in BCVA throughout the study period, with a mean improvement of +5.1 (FYB201) and +5.6 (reference ranibizumab) ETDRS letters at eight weeks. By week 48, the mean change from baseline was +7.8 ± 11.7 (median 8.0) for FYB201 and +8.0 ± 11.3 (median 8.0) ETDRS letters for ranibizumab. The ANCOVA least squares mean difference for change from baseline in BCVA between FYB201 and reference ranibizumab at week 48 was a negligible -0.1 ETDRS letters (90% CI -1.8 to 1.7, p>0.5).

|

The study also reported comparable adverse events between treatment groups, with no evidence of increased side effects, elevated intraocular pressure, or signs of ocular toxicity. Based on the study results, FYB201 was found to be biosimilar to ranibizumab in terms of clinical efficacy and ocular and systemic safety in the treatment of patients with nAMD.9

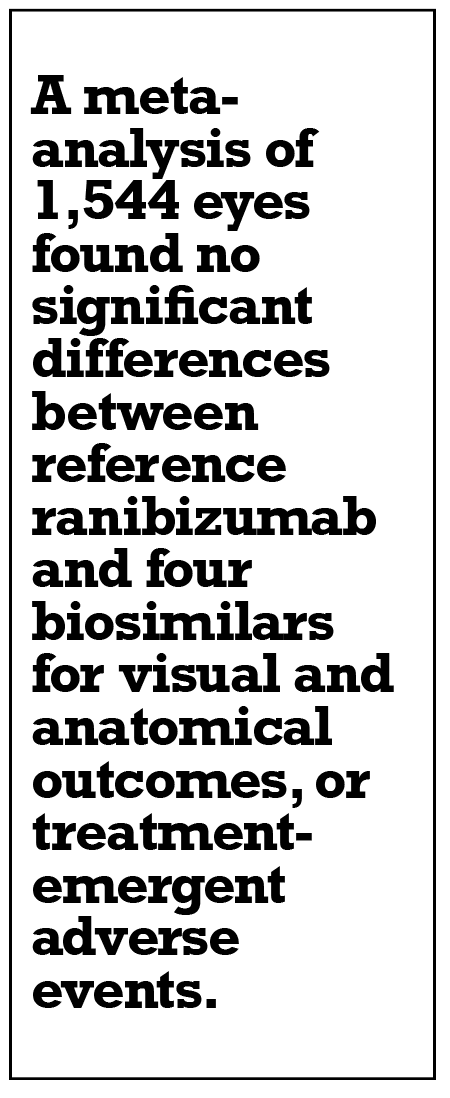

Additionally, a meta-analysis of four clinical trials comparing ranibizumab to four biosimilars in 1,544 eyes found no significant differences between the reference product and biosimilars for visual and anatomical outcomes, or treatment-emergent adverse events.10

Other Lucentis biosimilars

As of this writing, there is one Lucentis biosimilar awaiting approval in the United States: Xlucane, or XSB-001, also known as Ximluci in Europe (Xbrane Biopharma/Stada Arzneimittel). The European Union granted approval in 2022 and the United Kingdom did so last year. The FDA last year accepted the supplemental Biologics License Application (BLA) for Xlucane and set a Biosimilar User Fee Amendment goal date for April 21, 2024.

A comprehensive comparative analytical assessment demonstrated equivalency with Lucentis in terms of change in BCVA from baseline, with a least squares mean of 4.57 (95% CI 3.54 to 5.61) vs. 6.37 for Lucentis (95% CI 5.31 to 7.42).11 Likewise, change from baseline in central foveal thickness was also equivalent: -117.44 (95% CI, -125.33 to -109.56) for Xlucane vs. -115.14 (95% CI -123.14 to -107.14) for Lucentis.

Eylea biosimilars

No Eylea biosimilar has been approved in the United States, although one, Yesafili (Biocon Biologics), received market authorization from the European Commission and UK’s Medicines and Healthcare Products Regulatory Agency. 12

Regeneron Pharmaceuticals received pediatric exclusivity for Eylea in October 2022, which extended the U.S. market exclusivity of Eylea through to May 2024.13 Several companies, including Biocon Biologics, Amgen and Formycon, have filed BLAs with the FDA for Eylea biosimilars. Provided there are no legal challenges to the marketing of biosimilars, we should expect the first Eylea biosimilar to hit the market by late 2024. With Eylea generating more than $9 billion in global sales, expect to see a number of lawsuits and countersuits in the days ahead.

Use and market penetration

It’s apparent that the quality of physician–patient communication can have a large impact on the success of a biosimilar switch, and particularly on a phenomenon known as the “nocebo effect.” This is the opposite of the placebo effect, defined as “a negative effect of a pharmacological or non-pharmacological medical treatment that is induced by patients’ expectations, and that is unrelated to the physiological action of the treatment.”14

The nocebo effect may come into play when patients are switched from a reference biological to a biosimilar and may be triggered by perceptions of biosimilars as “cheap copies” of branded medicines. It can have a number of potential consequences—increased symptom burden, psychological distress, the number of adverse events patients experience, non-adherence, reduced quality of life, wasted medication, increased healthcare costs, more complicated treatment regimens and no apparent cost savings. Physicians can mitigate the effects of the nocebo effect by having a better understanding of biosimilars, including how they’re approved, and passing this increased confidence onto their patients.1,15

Because the two Lucentis biosimilars were the first biosimilars to be marketed to ophthalmologists in the United States, uptake by retina specialists was initially slow. It took time to educate retina specialists about biosimilars and what they mean in terms of treatment options for patients. At the same time, some retina specialists were also concerned about intraocular inflammation-related adverse events that were observed in some patients who were treated with other approved nonbiosimilar drugs.16 But consistent and clear messaging on the advantages of biosimilars, along with efficacy and safety data from postmarketing pharmacovigilance has played a significant role in the uptick in acceptance by the retina community.17

Unique challenges in ophthalmology

Biosimilar penetration in ophthalmology has encountered some unique challenges, the biggest of which is off-label Avastin (bevacizumab, Genentech/Roche) for treating retinal diseases. Although Avastin isn’t FDA-approved for use in retinal diseases, multiple studies, including those led by the National Eye Institute and the DRCR Retina Network, have demonstrated equivalency between use of Avastin and the approved anti-VEGF injections. Avastin must be compounded before it’s administered into the eye, and even with some cases of floaters, retina specialists have continued to prescribe it, usually as a first line of treatment before getting approval from payers for the more expensive Lucentis or Eylea.

|

Another factor that may be playing a role in acceptance of Lucentis biosimilars by retinal specialists is the recent approval of anti-VEGF injections such as Vabysmo (faricimab, Genentech/Roche) and Eylea HD (aflibercept, Regeneron), which have demonstrated longer durability and thus a decrease in injection frequency.

Lastly, some retina specialists have been averse to take up the Lucentis biosimilars due to financial reasons; they perceive that payers are benefiting more from the use of these biosimilars than the physicians or patients do. Biosimilar companies will need to provide retina specialists with information on how the use of biosimilars is going to benefit their practices.

The economics of biosimilars

Achieving the full cost-saving benefits of biosimilars requires patients currently receiving the reference product to switch.1 This would be ideal, although more work needs to be done in this regard.

When Byooviz was launched in June 2022, it was listed at a price of $1,130 per 0.05-mg single-use vial, approximately 40 percent lower than the list price of Lucentis. Cimerli launched with a list price of $1,360 for the 0.5-mg dose single-use vial and $816 for the 0.3-mg dose vial.18 This downward pressure on pricing in relation to the reference drug has definitely pushed payers to consider the biosimilars in place of the reference product.

A few companies that manage prescription drugs have chosen to remove the reference product, Lucentis, and have decided to add the two Lucentis biosimilars instead to their formulary.19 More such instances will come to light as the biosimilars continue to push their way into the mainstream.

Bottom line

The sponsoring companies are monitoring the two approved Lucentis biosimilars in post-marketing pharmacovigilance. Since their introduction, no reports of any major issues related to their use have emerged. This suggests that these biosimilars in ophthalmology are equally safe, while achieving similar visual acuity outcomes as the reference product.

The current approved Lucentis biosimilars, Byooviz and Cimerli, have helped change access to medications for retina specialists and reduce costs for patients and payers, or both. It’s imperative that we continue to have enough resources in our armamentarium to benefit patients, in terms of efficacy, access to care and reduced costs. As in other fields in medicine, biosimilars in ophthalmology will continue to play a substantial role in helping reduce barriers to access while reducing the cost of health care in general. RS

REFERENCES

1. Hariprasad SM, Gale RP, Weng CY, Ebbers HC, Rezk MF, Tadayoni R. An introduction to biosimilars for the treatment of retinal diseases: A narrative review. Ophthalmol Ther. 2022;11:959-982.

2. U.S. Food and Drug Administration. Overview for health care professionals. https://www.fda.gov/drugs/biosimilars/overview-health-care-professionals. Updated January 18, 2024. Accessed March 15, 2024.

3. U.S. Food and Drug Administration. Scientific considerations in demonstrating biosimilarity to a reference product. https://www.fda.gov/media/82647/download. Published April 2015. Accessed January 15, 2024.

4. U.S. Food and Drug Administration. Biosimilar product information. https://www.fda.gov/drugs/biosimilars/biosimilar-product-information. Updated March 12, 2024. Accessed March 15, 2024.

5. U.S. Food and Drug Administration. Interchangeable biological products. https://www.fda.gov/media/151094/download?attachment. Accessed January 15, 2024.

6. U.S. Food and Drug Administration. Updated FDA labeling recommendations for biosimilar and interchangeable biosimilar products. https://www.fda.gov/drugs/our-perspective/updated-fda-labeling-recommendations-biosimilar-and-interchangeable-biosimilar-products. Updated January 16, 2024. Accessed January 25, 2024.

7. Woo SJ, Veith M, Hamouz J, et al. Efficacy and safety of a proposed ranibizumab biosimilar product vs a reference ranibizumab product for patients with neovascular age-related macular degeneration: A randomized clinical trial. JAMA Ophthalmol. 2021;139:68.

8. Bressler NM, Veith M, Hamouz J, et al. Biosimilar SB11 versus reference ranibizumab in neovascular age-related macular degeneration: 1-year phase III randomised clinical trial outcomes. Br J Ophthalmol. 2023;107:384-391.

9. Holz FG, Oleksy P, Ricci F, Kaiser PK, Kiefer J, Schmitz-Valckenberg S; COLUMBUS-AMD Study Group. Efficacy and safety of biosimilar FYB201 compared with ranibizumab in neovascular age-related macular degeneration. Ophthalmology. 2022;129:54-63.

10. Hatamnejad A, Dadak R, Orr S, Wykoff C, Choudhry N. Systematic review of efficacy and meta-analysis of safety of ranibizumab biosimilars relative to reference ranibizumab anti-VEGF therapy for nAMD treatment. BMJ Open Ophthalmol. 2023;8:e001205.

11. ClinicalTrials.gov. Comparing the efficacy and safety of biosimilar candidate Xlucane versus Lucentis in patients with nAMD (XPLORE). https://clinicaltrials.gov/study/NCT03805100. Updated November 13, 2023. Accessed March 15, 2024.

12. Jeremias S. European Commission approves first aflibercept biosimilar. AJMC: The Center for Biosimilars. September 21, 2021. https://www.centerforbiosimilars.com/view/european-commission-approves-first-aflibercept-biosimilar. Accessed January 15, 2025.

13. Regeneron receives six months of U.S. pediatric exclusivity for Eylea (aflibercept) injection [press release]. Tarrytown, NY; Regeneron Pharmaceuticals. October 21, 2022. https://investor.regeneron.com/news-releases/news-release-details/regeneron-receives-six-months-us-pediatric-exclusivity-eylear. Accessed January 15, 2024.

14. Pouillon L, Socha M, Demore B, Thilly N, Abitbol V, Danese S, Peyrin-Biroulet L. The nocebo effect: A clinical challenge in the era of biosimilars. Expert Rev Clin Immunol. 2018;14:739-749

15. Sharma A, Kumar N, Bandello F, Loewenstein A, Kuppermann BD. Need of education on biosimilars amongst ophthalmologists: Combating the nocebo effect. Eye (Lond). 2020;34:1006-1007

16. Singer M, Albini TA, Seres A, et al. Clinical characteristics and outcomes of eyes with intraocular inflammation after brolucizumab: Post hoc analysis of HAWK and HARRIER. Ophthalmol Retina. 2022;6:97-108.

17. Nearly one year post-launch Biogen & Coherus Bosciences’ ranibizumab biosimilars have yet to make a splash in their respective retina markets [press release]. Exton, PA; Spherix Global Insights. June 23, 2023. https://www.spherixglobalinsights.com/nearly-one-year-post-launch-biogen-coherus-biosciences-ranibizumab-biosimilars-have-yet-to-make-a-splash-in-their-respective-retina-markets/. Accessed March 15, 2024.

18. FDA approves Byooviz as interchangeable Lucentis biosimilar. Formulary Watch. October 24, 2023. https://www.formularywatch.com/view/fda-approves-byooviz-as-interchangeable-lucentis-biosimilar. Accessed Jan-uary 15, 2024.

19. Myshko D. CVS Caremark switches up biosimilar coverage in 2024. AJMC. November 26, 2023. https://www.ajmc.com/view/cvs-caremark-switches-up-biosimilar-coverage-in-2024. Accessed January 15, 2024.